Currently, one of the largest risks to the world economy is financial fraud. The prevalence of digital transactions has led to fraudsters developing more complex strategies to take advantage of weaknesses in insurance networks, e-commerce platforms, banking systems, and fintech products. Industry reports state that financial fraud costs people and companies billions of dollars every year, eroding customer trust and income.

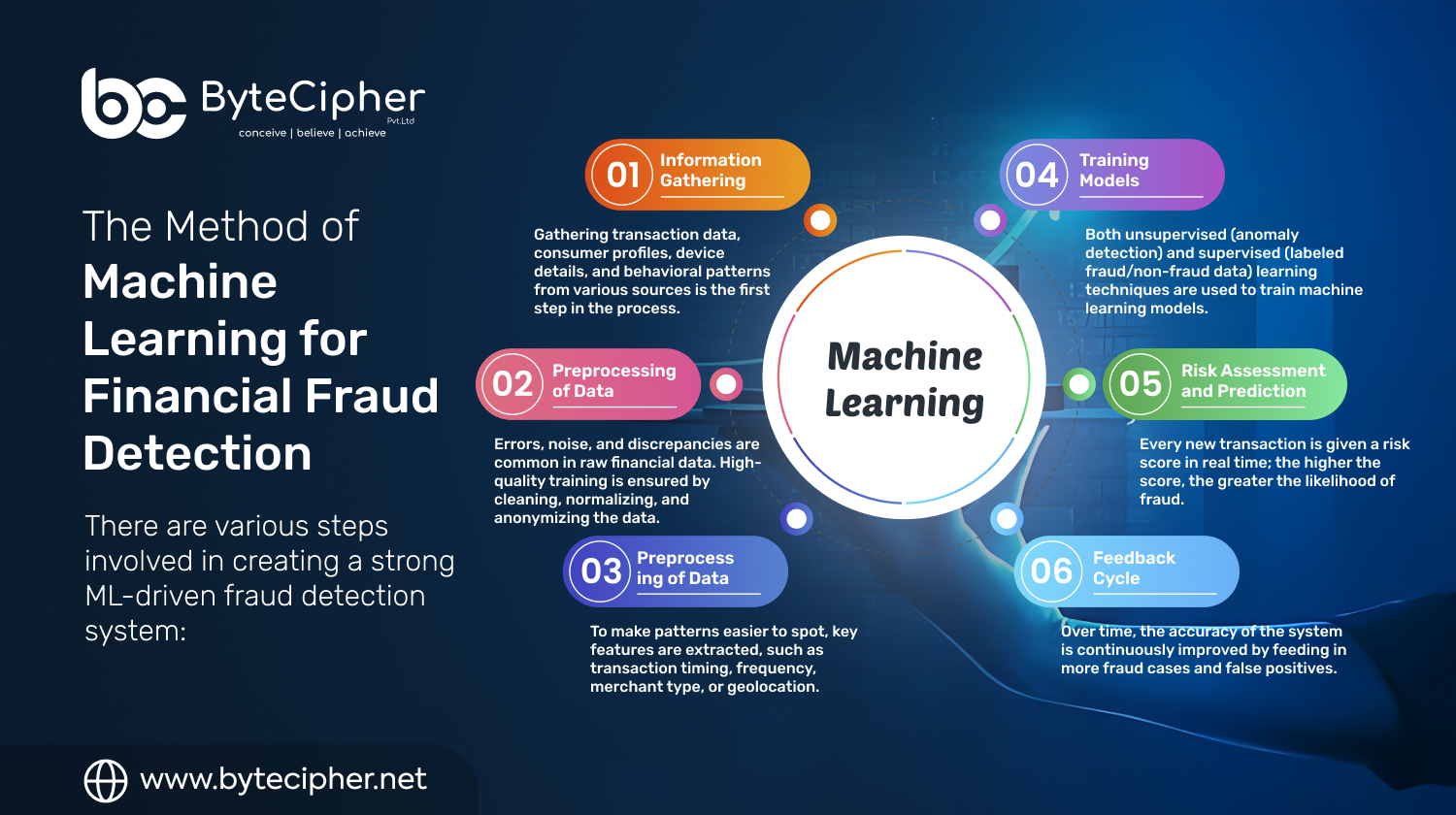

In the past, manual transaction reviews and static rule-based checks were successful ways for detecting fraud. But scammers are fast to adjust, coming up with new ways to target these inflexible systems. Here is where the financial industry is changing due to machine learning (ML). Massive amounts of data are analyzed in real time by ML-powered fraud detection systems, which also spot odd trends and keep improving to detect new fraudulent tactics.

Machine Learning is not just an upgrade; it represents a paradigm shift in fraud prevention, offering speed, adaptability, and precision that traditional methods cannot match.

What is Fraud Detection?

Fraud detection is the process of spotting actions that diverge from normal financial behavior that may be motivated by malice, like fraudulent claims, payment scams, misuse of stolen identities, or unauthorized account access.

Fraud detection is crucial in the financial sector since it:

- Protecting the assets and accounts of customers.

- Keeping businesses from suffering financial losses.

- Making certain adherence to governmental regulations.

- Preserving the trust of customers and brand reputation.

Institutions that do not have robust fraud detection systems in place run the danger of financial loss, regulatory fines, and dwindling client loyalty.

Advantages of Machine Learning for Fraud Identification

There are a number of benefits to switching to machine learning-based fraud prevention over conventional methods.

1. Detecting Fraud in Real Time

Instantaneous transaction processing is made possible by ML algorithms, which spot irregularities before scammers do. As a result, suspicious behavior can be stopped by banks and payment processors before it does harm.

2. Learning Adaptively

In contrast to rule-based solutions, machine learning picks up on changing fraud trends. Models continue to evolve and adapt as scammers alter their tactics, negating the need for frequent manual upgrades.

3. Decrease in False Positives

False positives, which occur when valid transactions are mistakenly reported as fraudulent, annoy consumers and put a strain on companies. ML systems are more accurate; they can more accurately differentiate between legitimate threats and typical behavior.

4. Operating Efficiency and Cost

Automation lessens the need for sizable manual review teams, allowing human analysts to concentrate on complicated, high-risk cases while AI manages routine analysis at scale.

5. Capability to Scale for High Volumes

Scalability is crucial because millions of transactions take place every day throughout the world. Even as transaction volumes increase, ML models continue to operate quickly and accurately while handling large datasets with ease.

ML vs Conventional Rule-Based Frameworks

Conventional fraud detection is based on predetermined guidelines like:

- Preventing purchases exceeding a specific threshold.

- Making a note of login attempts from unknown IP addresses.

- Unusual transaction frequency is identified.

Although they work well for simple threats, these regulations are strict and simple for scammers to get around if they know how to do it. For instance, if $5,000 is the barrier, a fraudster might just carry out several $4,999 transactions to evade detection.

Machine learning systems, on the other hand, adopt a more comprehensive and anticipatory strategy. The full transaction context—location, device type, spending habits, time of day, and past trends—is assessed by ML rather than depending on static constraints. Rule-based systems are unable to discover small irregularities due to the large number of variables that machine learning analyzes at simultaneously.

In a nutshell:

- Rule-Based = Static, Reactive, and Restricted.

- Machine Learning = Preemptive, Flexible, All-Inclusive.

Uses for Machine Learning in Fraud Detection

Machine learning is being used in a variety of financial fields and beyond, such as:

- Credit card fraud: Is the detection of unexpected increases in spending, strange locations, or duplicate transactions that don’t match the customer’s past patterns.

- Insurance fraud: Is the process of using anomaly detection to find fictitious claims, fraudulent documentation, or odd claim patterns.

- Loan and Credit Scoring: Evaluating the risks of applicants by looking at their income trends, repayment habits, and odd borrowing histor

- E-commerce fraud: identifying fraudulent returns, phony accounts, coupon misuse, and anomalous purchase quantities at particular periods.

- Identity Theft Prevention: preventing account takeovers through the use of biometrics, device fingerprinting, and login behavior analysis.

These examples demonstrate how machine learning (ML) offers both depth (effective insights in particular use cases) and breadth (useful across sectors).

Examples of Fraud Detection Using Machine Learning in the Real World

- Each year, billions of transactions are processed by PayPal. Its machine learning technologies are able to identify fraud in milliseconds, saving the organization millions of dollars in damages caused by fraud.

- By assigning real-time risk scores to transactions using AI-driven Decision Intelligence, Mastercard significantly lowers fraud rates while preserving seamless consumer experiences.

- In order to flag fraudulent claims more quickly than human auditors could, insurance companies are using machine learning to automate claim verification.

ML has emerged as a key business enabler in the fight against financial fraud, as demonstrated by these cases.

Fraud Detection Models Employing Machine Learning

The fraud detection scenario determines which machine learning models are used:

-

Simple and efficient for classifying binary fraud is logistic regression.

-

Decision Trees and Random Forests: Manage intricate fraud regulations in a comprehensible manner.

-

At scale, neural networks may identify nuanced, nonlinear fraud tendencies.

-

In high-dimensional datasets, Support Vector Machines (SVMs) are useful for detecting anomalies.

-

Map the connections between accounts, devices, and networks using graph-based models to find extensive fraud rings.

Many times, the type of fraud, the availability of data, and the required accuracy vs. interpretability trade-off all influence which model is best.

Present Difficulties in Fraud Detection Using ML

ML-powered fraud detection has challenges despite its potential:

-

Imbalanced Data: Fraud cases are infrequent compared to genuine transactions, making it harder to train balanced models.

-

Changing Fraud Strategies: Since fraudsters are always changing, models must also change swiftly.

-

Data Privacy and Compliance: Regulations such as GDPR, PCI DSS, and RBI recommendations must be followed by financial organizations.

-

Explainability Problems: Deep neural networks and other complex models may behave as “black boxes,” making it challenging to defend choices to regulators.

Integration with Legacy Systems: The deployment of machine learning solutions is complicated by the fact that many banks continue to rely on antiquated IT infrastructures.

Drug discovery powered by AI is allowing pharmaceutical companies to innovate at scale, improving patient outcomes, accelerating the release of life-saving medications, and changing the course of medicine.

ByteCipher’s Top Techniques for Preventing Machine Learning Fraud

At ByteCipher Pvt. Ltd., we assist companies in putting in place accurate, scalable, and compliant machine learning (ML)-powered fraud detection systems. Among our finest practices are:

- Constructing top-notch datasets using appropriate balancing strategies to manage infrequent fraud incidents.

- Creating hybrid models for layered security that blend machine learning with conventional rule-based systems.

- Deploying real-time monitoring technologies that rapidly indicate problems without affecting client experience.

- Ensuring adherence to RBI, GDPR, HIPAA, and PCI DSS regulations.

- Implementing continuous learning systems with automatic feedback loops for adjusting to new fraud strategies.

Our strategy guarantees that companies can minimize losses, safeguard client confidence, and identify fraud more quickly.

Think of ByteCipher as your reliable companion

Fraud detection is a strategic imperative rather than merely a technical problem. It need a mix of sophisticated machine learning models, safe infrastructure, and compliance knowledge to protect your clients and assets.

To create end-to-end fraud prevention systems that meet client needs, ByteCipher collaborates with banks, fintech companies, insurers, and e-commerce enterprises. We provide solutions that blend creativity with confidence, ranging from scalable cloud-based AI platforms to real-time anomaly detection.

When you work with ByteCipher, you get a partner who makes sure your fraud detection systems are smart, legal, and prepared for the future.

FAQs

Q1. What makes machine learning superior to conventional fraud detection methods?

ML is flexible and dynamic. ML continuously learns from novel fraud behaviors, increasing accuracy and lowering false alarms in contrast to older systems that depend on set rules.

Q2. Which sectors gain the most from fraud detection using machine learning?

The top sectors where machine learning is revolutionizing fraud prevention include banking, insurance, e-commerce, digital payments, and fintech.

Q3. Can fraud be totally eradicated by machine learning?

100% prevention cannot be guaranteed by any system. However, by identifying and thwarting fraud efforts before they become more serious, machine learning dramatically reduces risks.

Q4. How much does ML-based fraud detection cost?

ML lowers long-term costs by automating procedures, eliminating manual reviews, and averting significant financial losses, even while the initial setup needs investment.

Q5. How is compliance in fraud detection solutions ensured by ByteCipher?

In order to guarantee security, compliance, and transparency at every turn, we develop solutions which are in line with PCI DSS, GDPR, RBI, and international financial rules.